Special Provisions

Survivor Benefit Plan

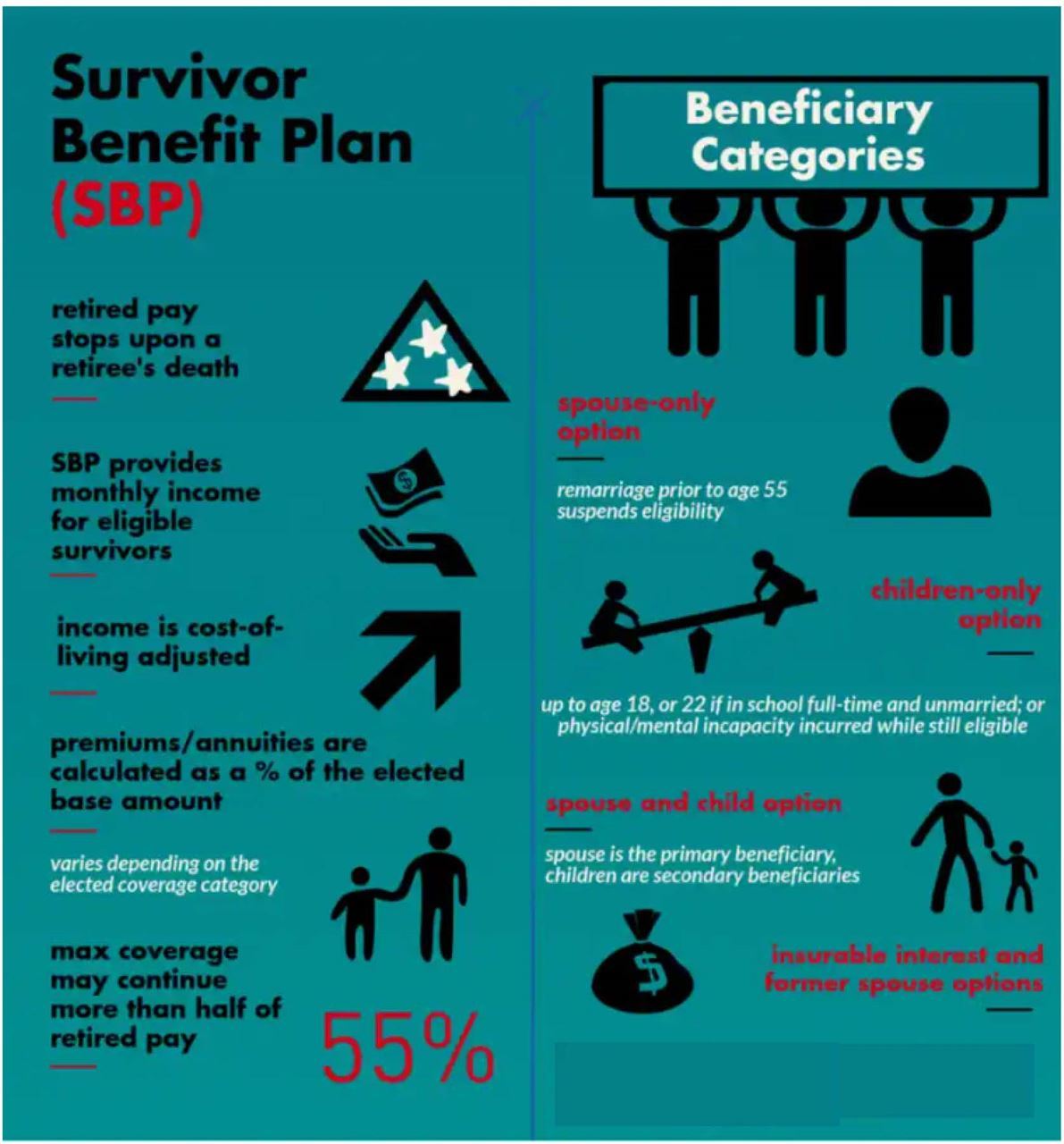

While you are on active duty, if you have a spouse and/or dependent children, they are automatically covered by the Survivor Benefit Plan (SBP) at the highest level at no cost to you. Prior to your retirement date, you must decide whether you want to continue SBP coverage into retirement. If you elect SBP coverage, you must pay premiums once you retire. SBP premiums are collected by reducing your retired pay, and they are not counted in your taxable income. This means less tax and less out-of-pocket cost for SBP. Also, the overall Plan is funded by the Government (subsidized), so the average premiums are well below cost.

If you elect SBP coverage, you must elect a level of coverage or “base amount”. The base amount is used to calculate both your cost and your survivor’s annuity. Full coverage means your gross retired pay is your base amount, but the base amount can be any dollar figure between your gross monthly retired pay, down to as little as $300. When retired pay gets a cost-of-living adjustment (COLA), so does the base amount, and as a result, so do the premiums and the annuity payable.

If you elect SBP coverage, you must also elect a category of beneficiary (i.e.., spouse only, child only, spouse and child, former spouse, former spouse and child, or insurable interest person). After retirement, your election cannot arbitrarily be changed.

Beneficiary Categories

Pre-Retirement Actions

Prior to your retirement date, AF retiring members are required to attend a personal one-on-one SBP briefing with an AF SBP counselor. If you are married, your spouse should also attend the briefing. The law requires both you and your spouse to be fully informed of the options and effects of the SBP so that you can make an informed decision and so that your spouse will understand the implications of your decision.

Do not depart on PCS or terminal leave until you have received your one-on-one SBP briefing and completed a DD Form 2656. If you are married, you may not elect reduced spouse coverage or to decline spouse coverage without your spouse’s written consent on the DD Form 2656 after you make the election. The election can be changed at any time prior to your retirement date if you change your mind. If you do not complete a DD Form 2656 with a valid SBP election prior to your retirement date, DFAS will establish full automatic spouse and child SBP coverage.

For more information about SBP, please contact the SBP counselors at Scott AFB Military & Family Readiness Center or by calling (618) 256-6508.

Spouse CoverageSpouse Coverage If you elect spouse coverage, you’re covering the spouse you’re married to at the time of your death. Upon your death, benefits will be payable for the lifetime of your spouse and are not interrupted if he/she remarries after age 55. They are, however, suspended upon remarriage before age 55, and resume if that remarriage ends by death or divorce. The SBP annuity payable to your spouse is 55 percent of the base amount you elect. If your spouse dies, if you divorce, or if you remarry, you must promptly notify the Defense Finance and Accounting Service (DFAS). This ensures SBP premiums are properly suspended or resumed. Otherwise you may end up owing a large debt for unpaid premiums. Former Spouse CoverageFormer Spouse Coverage A member, who has a former spouse, may elect to provide SBP coverage for that former spouse upon retiring. An election for former spouse prevents payment of an annuity to a spouse. This option may be elected by a retiring member either voluntarily or mandated by a divorce agreement. The SBP annuity payable to a covered former spouse is 55 percent of the selected base amount. Instructions for changing spouse coverage to former spouse coverage upon divorce after retirement: A spouse loses eligibility as a “spouse” beneficiary following divorce. If you wish to continue to cover your now former spouse either voluntarily or as a requirement in a divorce agreement, you must convert your SBP election from spouse to former spouse coverage within one year of the date of the divorce. To convert spouse coverage to former spouse coverage, you must submit a properly completed DD Form 2656-1, SBP Election Statement for Former Spouse Coverage, to DFAS along with a copy of the divorce decree to include the settlement agreement. If DFAS is not notified within the first year of divorce, the former spouse is not eligible for annuity payments even if you continue to pay SBP premiums. In converting to former spouse coverage, you may not change your SBP base amount. Electing former spouse coverage will prevent you from covering a new spouse at the same time if you remarry. Insurable Interest CoverageInsurable Interest Coverage If you’re not married and have no dependent children, you may be able to elect coverage for an “insurable interest” person. This must be a natural person (not a company, organization, fraternity, etc.) with a financial interest in your life. It can be a close relative or a business partner. If the person is related closer than a cousin, proof of insurability is not required. If you are not married and have only one dependent child, you may elect insurable interest coverage for that child. An insurable interest annuity is paid for the lifetime of the beneficiary. An election of insurable interest coverage requires full retired pay as the base amount. Insurable interest premiums are 10 percent of full retired pay, plus an added 5 percent for each full five years you are older than the beneficiary. Total costs, however, cannot exceed 40 percent of your full retired pay. Insurable interest benefits are equal to 55 percent of the retired pay remaining after subtracting the SBP premium. | Unmarried at RetirementInstructions for a member unmarried at retirement: If you do not have a spouse on your date of retirement and later marry, you may elect SBP coverage for the new spouse. In order to establish the coverage, you must notify DFAS in writing before your first wedding anniversary. The new spouse becomes an eligible beneficiary on the first anniversary of the marriage or upon the birth of a child of the marriage if before the first anniversary. You do not pay premiums until the new spouse becomes an eligible beneficiary. Child CoverageChild Coverage You may elect coverage only for your eligible children (Child Only Coverage) or you may include them with spouse/former spouse coverage (Spouse and Child Coverage or Former Spouse and Child Coverage). There is only one annuity. In the later options, eligible children are paid the annuity only if your spouse/former spouse dies or remarries before age 55. Children are eligible for the annuity only during the time they are unmarried and:

Eligible children may include adopted children, stepchildren, foster children, grandchildren, and recognized natural children who live with you in a regular parent-child relationship. To qualify as a dependent child, a grandchild must be in your care and custody by court order and meet dependency requirements. To qualify as a dependent child, a foster child must receive over one-half support from you and such support must not have been provided under a social agency contract. When you include child coverage with former spouse coverage (Former Spouse and Child Coverage) only your children of the marriage to that former spouse are covered. Any other children will not be paid benefits under this option. In the child only option or when you include children with spouse (not former spouse) coverage, all of your eligible children are covered. Monthly premiums for including children with spouse coverage are based on the ages of the member, spouse, and youngest child at the time the coverage becomes effective. In the case of child only coverage, the premium is based on the ages of the member and youngest child at the time the coverage becomes effective. Eligible children equally divide the annuity which is 55 percent of the base amount. For example, if five children are eligible, each is paid one-fifth of the annuity. When the first child reaches age 18 with no incapacity and if no longer in school, each of the remaining four is paid one-fourth of the annuity. This process continues until the youngest child is no longer eligible to receive benefits. |

Disenrollment Provision You are authorized a one-year window between your second and third anniversary of receiving retired pay in which you can disenroll from SBP. That allows members who may have a financial crisis or simply decide they no longer need the SBP protection for their survivors, to permanently get out of the Plan. This requires the concurrence of the spouse, there is no refund of premiums, and you will be forever barred for reentering. Once the window closes, the election becomes basically irrevocable. | Paid-Up Provision Public Law 105-261 was signed into law 17 Oct 98. It stipulates that effective 1 Oct 2008, retired members age 70 or older who have paid into SBP for at least 30 years (360 full payments) will be considered “Fully Paid-Up”. No further premiums will be deducted from their retired pay, but their eligible beneficiary will still receive an SBP annuity when they die. |